SPY Disadvantages for Long Term Investors Hidden Costs Facing US Portfolios

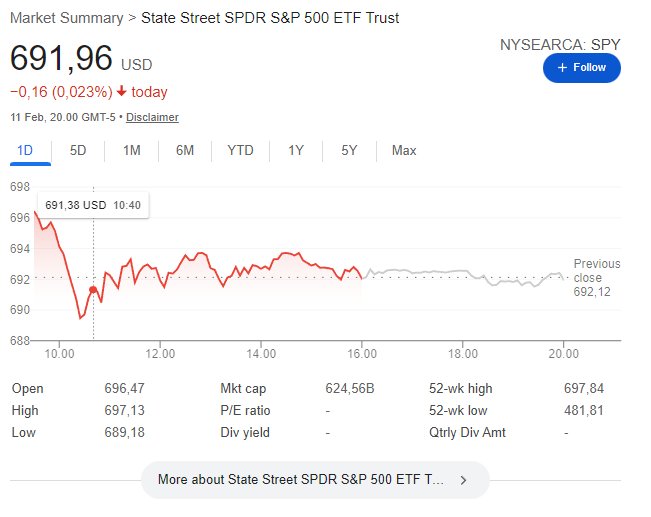

SPY disadvantages for long term investors warrant further scrutiny since the SPDR S&P 500 ETF Trust is frequently regarded as a fundamental core investment in American portfolios. SPY offers deep liquidity, brand recognition, and reliable index tracking.

Long term ownership still carries structural and cost related limitations that may not align with buy and hold strategies. This article analyzes the hidden costs, structural constraints, tax implications, and concentration risks that US investors should evaluate before holding SPY over multiple decades.

SPY Legal Structure as a Unit Investment Trust

SPY operates under a Unit Investment Trust structure rather than the open end ETF format used by many competitors. This legal framework restricts operational flexibility. The fund cannot reinvest dividends internally before distribution. It also cannot actively lend securities in the same flexible manner as some open end ETFs.

These structural limitations represent core spy disadvantages for long term investors. While short term traders may prioritize liquidity, long horizon investors benefit more from structural efficiency. A Unit Investment Trust must hold all index constituents in fixed proportions, limiting internal optimization strategies. Over decades, small structural inefficiencies accumulate and reduce compounding potential.

Higher Expense Ratio Compared to Competing S&P 500 ETFs

SPY currently carries an expense ratio of approximately 0.09 percent. Competing S&P 500 ETFs such as VOO and IVV offer expense ratios closer to 0.03 percent. The difference appears minimal on an annual basis. Over long investment periods, cost divergence becomes meaningful.

For long term investors focused on cost minimization, this fee gap forms one of the primary spy disadvantages for long term investors. Even a 0.06 percent annual difference compounds significantly across decades. Lower cost alternatives tracking the same index create a structural disadvantage for SPY in purely long horizon scenarios.

Tax Efficiency Limitations for US Investors

SPY distributes dividends quarterly and must pass through income without reinvestment flexibility. Although ETFs are generally tax efficient due to in kind redemption mechanisms, SPY’s structure slightly limits optimization compared to certain open end ETF formats.

Dividend distributions create taxable events for investors holding SPY in brokerage accounts. Capital gains distributions remain rare but are possible. Spy disadvantages for long term investors increase when portfolios are heavily allocated in taxable accounts rather than tax advantaged retirement vehicles. Over extended horizons, repeated taxable distributions reduce after tax compounding.

Dividend Reinvestment Constraints Inside SPY

Unlike open end ETFs that can internally manage cash positions more dynamically, SPY distributes dividends on a fixed schedule. Investors must manually reinvest dividends through brokerage dividend reinvestment plans. This introduces small but persistent cash drag between payment date and reinvestment execution.

Dividend yield on SPY typically ranges between 1.3 percent and 1.6 percent depending on market conditions. For investors compounding dividends over 20 to 30 years, reinvestment timing matters. Spy disadvantages for long term investors include the absence of internal reinvestment smoothing mechanisms that may marginally improve tracking efficiency.

Long Term Cost Compounding Impact Analysis

Cost compounding illustrates how expense differences influence portfolio outcomes over extended periods. The following table compares long term growth assuming a USD 1,000,000 investment over 30 years with a 7 percent gross annual return.

| Expense Ratio | Ending Value After 30 Years | Total Fees Paid |

| 0.09% (SPY) | USD 7.36M | USD 248,000 |

| 0.03% | USD 7.57M | USD 83,000 |

| 0.15% | USD 7.11M | USD 410,000 |

The difference between 0.09 percent and 0.03 percent results in approximately USD 210,000 in additional portfolio value over three decades. Spy disadvantages for long term investors become increasingly visible as portfolio size grows and compounding duration extends.

While SPY remains cost efficient relative to active mutual funds, it is not the lowest cost S&P 500 exposure available in the US market.

Portfolio Concentration Risk Within the S&P 500

SPY tracks the S&P 500, which is market capitalization weighted. In recent years, the top ten holdings have represented over 30 percent of index weight. Mega cap technology companies dominate index performance during growth cycles.

This concentration introduces sector specific risk that may not be immediately apparent. Investors often assume 500 stocks equal broad diversification. Weighting methodology results in heavy exposure to a small cluster of large corporations.

Spy disadvantages for long term investors include sensitivity to technology sector corrections, valuation compression in growth stocks, and macroeconomic shifts affecting mega cap earnings. During market rotations into small cap or value sectors, SPY may underperform more diversified or equal weighted strategies.

Long term investors relying solely on SPY risk overexposure to US large cap equities without geographic or factor diversification.

When SPY Still Makes Sense for US Market Participants

Despite structural limitations, SPY continues to serve a purpose in certain portfolio contexts. Its daily trading volume remains among the highest of any ETF in the world. Institutional investors, active traders, and options market participants benefit from tight bid ask spreads and deep liquidity.

Short to medium term investors prioritizing execution efficiency may find SPY optimal. Tax advantaged retirement accounts reduce some of the tax related spy disadvantages for long term investors. For investors who value liquidity above marginal cost differences, SPY remains practical.

Long term portfolio construction requires aligning ETF selection with investment horizon, account type, and capital scale. Investors focused on minimizing lifetime expense drag may evaluate lower cost alternatives tracking the same index. Investors prioritizing liquidity and trading flexibility may accept structural trade offs.

Understanding spy disadvantages for long term investors allows US market participants to make informed allocation decisions rather than defaulting to brand familiarity. Passive investing reduces complexity but does not eliminate structural considerations. Long term success depends on evaluating cost, concentration, taxation, and compounding impact within a disciplined investment framework.